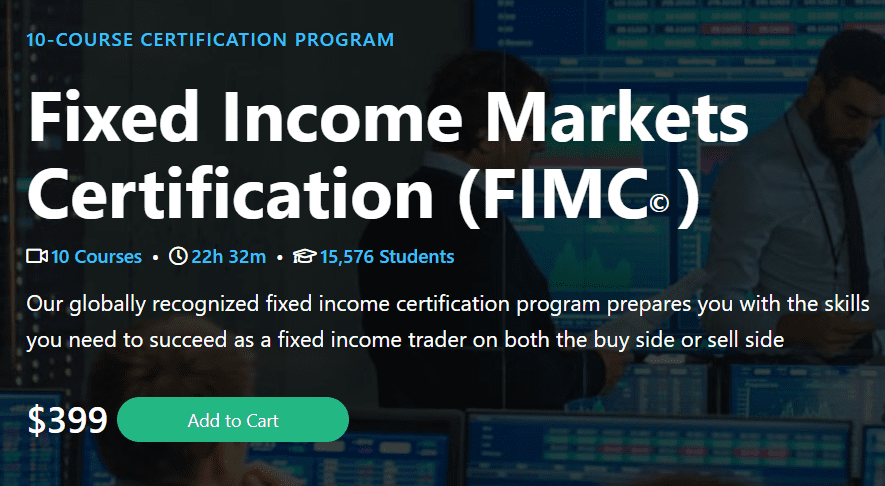

[Download Now] Fixed Income Markets Certification – Bundle

Original price was: $399.00.$99.00Current price is: $99.00.

Product Delivery – You will receive Content Access Via Email.

Email – [email protected]

Description

Eric Cheung – Fixed Income Markets Certification – Bundle

Eric Cheung – Fixed Income Markets Certification – Bundle

A globally recognized certification program to prepare trainees with the skills they need to succeed as a Fixed Income Trader on either the Buy Side or Sell Side

-

Earn a verified certification

Shareable on LinkedIn and in resumes

-

Finish in 1 month

Recommended pace 6 hours/week

-

Globally Recognized

The same rigorous training program used by salespeople and traders at top global investment banks

Major Skills Covered

- Bond Math

- Yield Curves

- Money Markets

- Government Bonds

- Corporate Bonds

About this Certification Program

While other Fixed Income courses add formulas and complexity to hide the lack of real-world experience, Wall Street Prep’s Fixed Income Markets Certification was created by former sales and trading professionals focused on what interns, new hires and early career analysts need to know on the job.

Designed following extensive discussion with hiring managers at major investment banks, we built our Fixed Income program around practical requirements like Bloomberg, with Excel exercises to demystify how Bloomberg calculates Yield and Duration on a bond.

-

9+ Hours of Video Instruction. Acquire expertise taught from an insider’s perspective. Master how to use the Bloomberg terminal to analyze bonds, yields and cashflows.

-

A Comprehensive Program.Designed with input from the largest global investment banks on what Fixed Income salespeople and traders need to know.

-

Meaningful, Shareable Certification. Graduates will receive a blockchain-verified, shareable certification that can easily be added to LinkedIn and resumes.

Top Jobs the FIMC Will Prepare You For

Position 1st Year Salary + Bonus * Credit Trader $135-160,000 Rates Trader $135-160,000 Fixed Income Salesperson $135-160,000 Fixed Income Structurer $135-160,000 Fixed Income Quant $175-200,000 Fixed Income Portfolio Manager $105-130,000 Debt Capital Markets Analyst $135-160,000 Corporate Treasury $100-125,000* glassdoor.com estimates.

$145K

The average starting salary + bonus for Fixed Income Markets Sales & Trading Analysts. See our Sales & Training Salary Guide for more details of the career and pay progression. Data on average starting salaries is based on glassdoor.com U.S. estimates.

What You’ll Learn

- Master the Bloomberg Bond DES screen

- Learn how bond traders and investors measure returns

- Decode the pricing and trading conventions of bonds

- Learn how to chart, graph and analyze bonds and yield curves on Bloomberg

- Use the Bloomberg Bond Calculators for Discounts and Yields

- Discover the Central Bank tools that move markets

- Calculate cashflows, yields and duration of actual bonds

- Demystify the difference between G, T I and Z spreads

- Understand the pricing and valuation process of new issue corporate bond

The FIMC© is the same program used to train new hires at Wall Street’s largest investment banks.

WSP trains investment professionals and traders at the world’s largest sell-side investment banks and buy-side asset managers.

“Our employees are telling us this is the best virtual learning experience they have ever had.

— Associate Director, Learning & Development

Global Investment Bank”

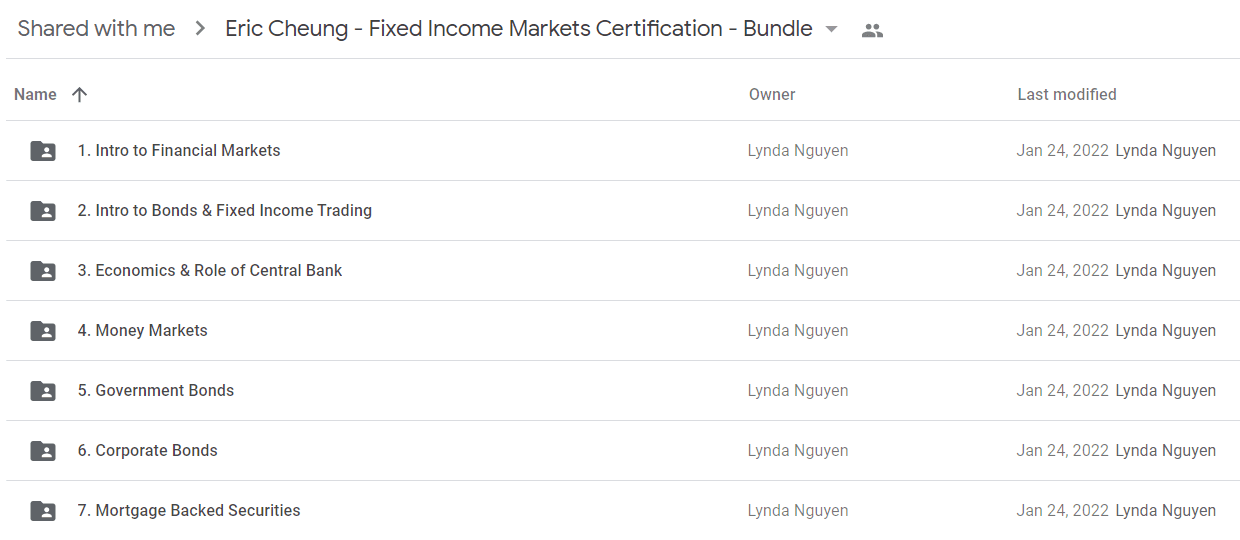

Includes 7 core courses + 3 electives

Intro to Financial Markets

Intro to Bonds & Fixed Income Trading

Economics & Role of Central Bank

Money Markets

Government Bonds

Corporate Bonds

Mortgage Backed Securities

ElectiveCrash Course in Bonds and Debt

ElectiveDebt Capital Markets Primer

ElectiveDebt Capital Markets: How to Survive Day 1

Designed for incoming and prospective DCM/Capital Markets analysts and interns with no prior DCM experience, this course will provide an insider’s prospective of what you”ll be doing on the job. We’ll focus on industry knowledge not taught in school and demystify industry jargon. We start with the basics: what DCM actually does, what a DCM desk looks like and how to use the tu

Proof Content

Sale Page: https://www.wallstreetprep.com/self-study-programs/fixed-income-markets-certification-program/

Archive: https://archive.ph/wip/kWXCQ

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from imcourse.net.

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC+8).

Thank You For Shopping With Us!

![[Download Now] Fixed Income Markets Certification - Bundle](https://coursemarket.shop/wp-content/uploads/2023/12/download-now-fixed-income-markets-certification-bundle.png)

Stephanie Hayes (verified owner) –

The instructor was very knowledgeable and approachable.

Michael (verified owner) –

This course provided a solid foundation for further learning.

Christopher Taylor (verified owner) –

Great value for the price. Highly recommend!

Kayden (verified owner) –

I found the lessons to be very practical and applicable.

Amy Cooper (verified owner) –

The lessons were clear and easy to understand.

Samuel (verified owner) –

I learned so much from this course. The instructor’s knowledge is impressive.